We listened to your feedback and challenged ourselves to bring a product to market that streamlines conditions at the same time as providing wider cover. This approach to critical illness insurance throws out the idea that every condition it pays on needs to be listed.

We’re checking out of the conditions race, with cover that’s all about customers, not just a list of conditions. So say hello to flexibility that delivers fairer customer outcomes and value for money from day one.

Choose flexibility

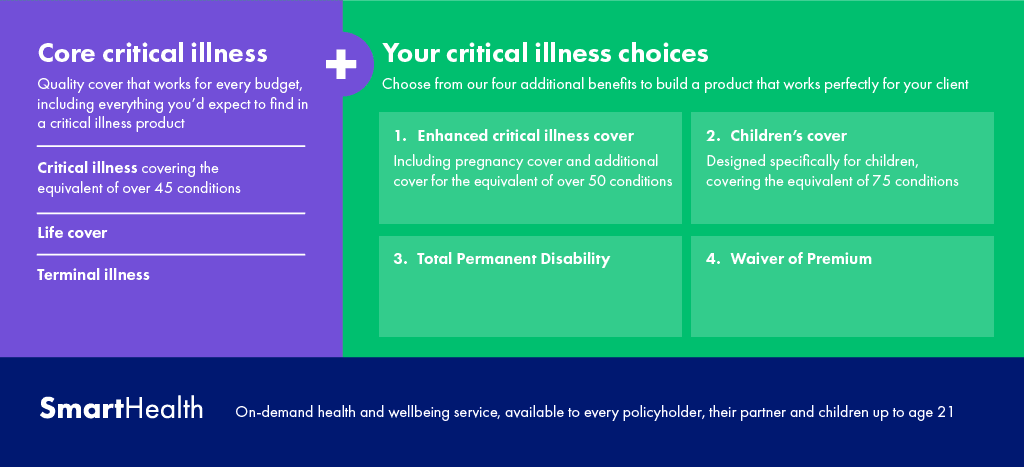

Every client is different, so we’ve designed critical illness cover that gives them, and you, flexibility. It’s simple. Start with our core critical illness cover and take it from there, with flexible optional benefits that can be added at the point of sale and removed at any time. You can tailor your recommendation to your client’s needs and budget – meaning they only pay for what they need.

Choose value from day one

Smart Health is included at no additional cost for all critical illness policyholders. An award winning health and wellbeing service, Smart Health has been valued by customers at £43 per month1. From day one of their cover, it connects your clients, their partners, and their children up to the age of 21, to the healthcare professionals they need.

With Smart Health your clients get:

- Access to health and wellbeing advice 24 hours a day, 365 days a year

- 30 minute on-demand online or over the phone GP appointments

- Mental health support from psychologists

- Personalised fitness and nutrition plans

- Access to a second medical opinion from Best Doctors®

In short, Smart Health means no lengthy waits to see a GP, free access to expert support, and a second medical opinion from over 50,000 specialists worldwide. And because your clients’ partners and children can access Smart Health too, looking after the whole family has never been so easy.

1 Source: AIG Life commissioned research, ID Consulting, January 2020: 2000 sample size.

Smart Health is a non-contractual benefit provided by Teladoc Health which can be withdrawn at any time without notice.

Choose better customer outcomes

Our critical illness is all about customers; it’s not just a list of conditions. Our new approach is simple. First and foremost, each condition we include must benefit the customer. We won’t add conditions for the sake of it and we’ve removed those that have never resulted in a claim.

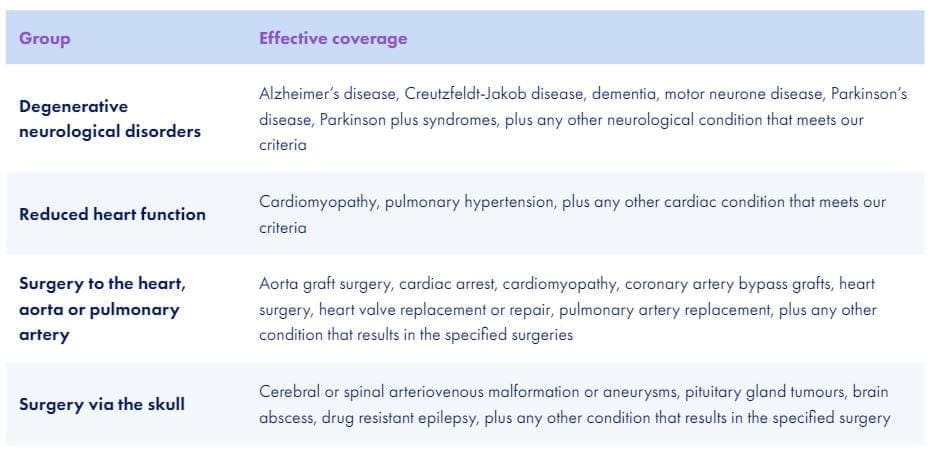

We’ve included the umbrella conditions you’ll be familiar with so that they’re simple to explain and easy to understand. We’ve consolidated similar conditions without reducing cover and introduced four new grouped conditions focusing on specific surgeries or the effect medical conditions have on customers. This means we offer broader, fairer cover, whilst reducing the condition count.

By focusing on the impact, rather than the cause of an illness, pay-outs are based on the severity of a condition or procedure and the resulting impact on a customer’s life. They can be confident that new medical discoveries won’t diminish their cover and that it keeps pace with tomorrow.

Find out more

Want the full details on every element of our new critical illness cover? Our dedicated product page has everything you’ll need to know.