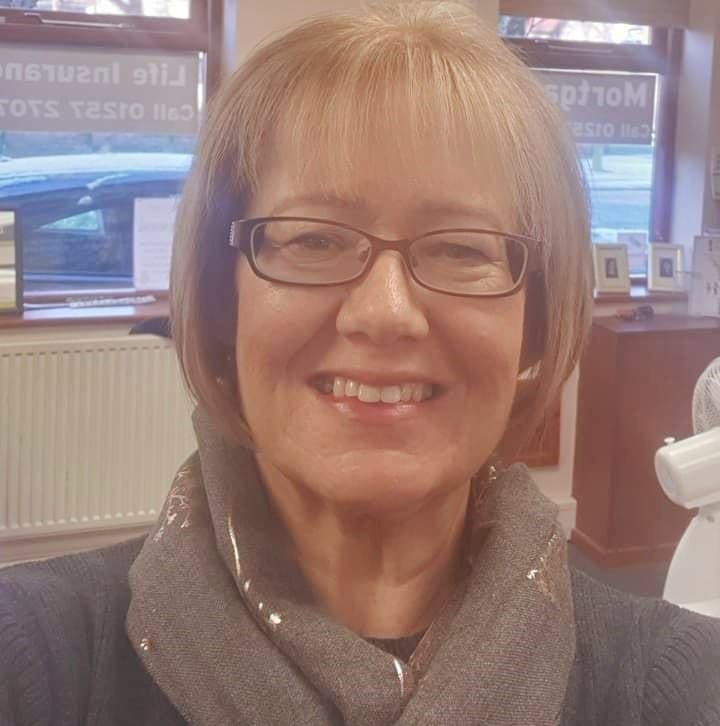

We want to showcase you, our broker heroes, and the difference you make to your clients’ lives through the protection solutions you put in place. Our next broker hero showcase is Sue Smith, Churchside Financial Planning.

Sue’s Story

Sue’s client got in touch to share their story:

“In July 2016 I was discussing mortgage options with Sue Smith from Churchside Financial Planning when she suggested I also took out a Critical Illness Protection policy.

This is something I had never considered before with the attitude that “nothing will happen to me”, plus it meant an extra monthly premium that I’d rather spend on myself. At that time I was a 47 year old contractor with no employer benefits. Although I was in good health, I listened to what Sue had to say about various policy options and how a person’s life can change for the worst overnight. Sue highlighted examples of the benefits from having financial security ‘just in case’. One example was that of a relative who’d had a serious life changing accident and that his cover helped him enormously.

I took her advice and we arranged Critical Illness Cover. In late December, 2019 I was diagnosed with bowel cancer. I was successfully operated on early in February, but was unable to work for four months. After that recovery period I was still only able to work from home on very reduced hours. My income has suffered massively.

Fortunately I had Critical Illness Cover (I had only been contributing for three and a half years at £99 per month and the insurance settled the full amount (£125k) without question.

I still get shivers as to what may have become of me without cover and with no savings to fall back on with a large mortgage, two cars to run, a motorhome, child maintenance for three kids, birthdays, Christmas, holidays, water, gas, electric, TV subscription, drinking, socialising, take-aways… a list that I’d always taken for granted and goes on and on.

The reward has also helped me as a sort of recompense for the suffering I’ve had, including my limited mobility as a result of the operation. My grateful thanks go to Sue Smith for convincing me to take cover.”