As we continue to welcome all our new firms, brokers and PRIMIS colleagues, we also strive to continue bringing you the solutions that we are confident that our growing network will benefit from. With help from your feedback, we have been able to evolve one of our most essential broker tools – our CRM service Toolbox, with an ongoing cycle of development that adapts to meet your needs. Learn all about our upcoming changes and tweaks here to find out what you can experience the next time you log in to Toolbox.

What is Toolbox?

For those of you who aren’t aware, Toolbox is an exclusively developed CRM system we offer to our network of brokers and advisers here at PRIMIS. As an all-in-one CRM solution, Toolbox delivers a lot in terms of functionality with the overall goal of the system being to facilitate successful outcomes and reduce the amount of time spent on the admin side of cases. While this is the driving force behind Toolbox’s inception and continued refined, the system is also capable of the following:

- Increasing advice efficiencies

- Driving lead generation, sales and quality

- Offering high-level security and compliance

- Facilitating seamless integration to sourcing systems

- Continuously evolving to meet brokers’ needs

To learn more about what Toolbox is and what its many benefits are, as well as receive a brief overview of how to make the most of the service, watch the following video here.

What are the Latest Updates to Toolbox?

Consumer Duty Changes

As part of the Consumer Duty changes, we have been asked to amend some sections within the Universal

Fact Find. Within this release we have the following sections that have changed:

- Front Cover page – If Non-Face to Face

- Personal Details – Gender

- Personal Details – Dependants

- Personal Details – Employer Benefit Details

- Get Quotation > Solution Builder page > Displaying Create Policy button alongside Apply button

Fact Find > Front Cover – Form of Meeting

This has now been changed to only show 2 options:

- Face to Face

- Non-Face to Face

For historical Fact Finds where previous options of Telephone/Voice call, Email, Post, Online and Video

Conferencing, these will all be mapped to Non-Face to Face.

If Non-Face to Face is selected there is a further question asked, which will be mandatory at point of saving the page. This has been amended to ‘If Non-Face to Face, Please select details of the impersonation check completed’ with the following options:

- Hard copy of correspondence issued to the client’s address.

- Called client on the associated (verified) land line telephone number.

- Hard copy of original bank statement/utility bill (less than 3 months old) obtained.

- Existing client only where previously fully verified – Called client on a mobile telephone which has previously been used to contact the customer.

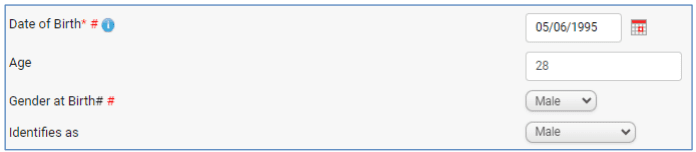

Fact Find > Personal Details – Gender

Following feedback to the Consumer Duty team we have now amended the following when recording your customers gender within the Fact Find:

- Gender has changed to read – Gender at Birth

- Added ‘Identifies as’ with following 4 options:

- Male

- Female

- Gender Neutral

- Other

These changes will also bring the gender questions in line with those asked on the Connect Platform.

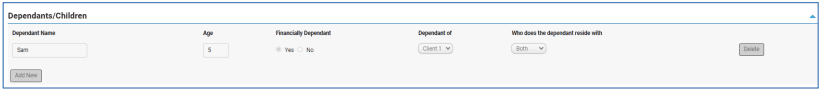

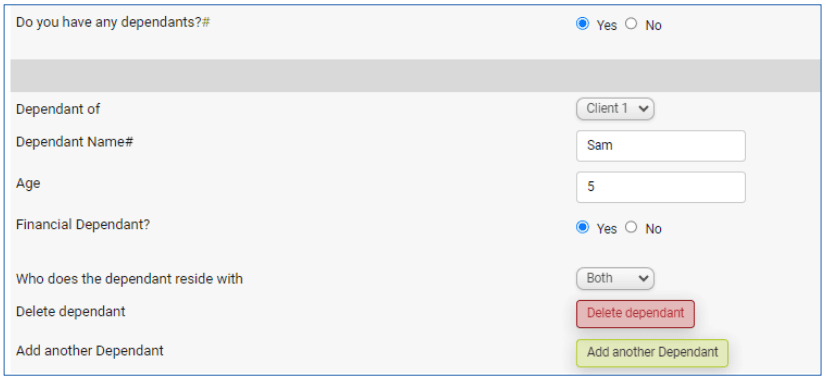

Individual Client > Main Details & Fact Find > Personal Details – Dependants

This is on both the Individual Client page when creating a client and within the Fact Find > Personal Details page. You are now asked to record the following:

- Dependant of – this is a new field and will provide you with a drop down of Client 1, Client 2 or both. If single client, then it will default to Client 1.

- Dependant Name – Existing field.

- Age – New field with numerical box allowing number 0-120. For any existing dependants where DOB has been entered, we will calculate the age based on DOB.

- Financial Dependant? – New field with Yes or No option to select

- Who does the dependant reside with? – New field with Client 1, Client 2, Both or Other options to select. If single client, it will default to Client 1 but can be amended.

Note: All the above are mandatory fields if a dependant is added. Please remember to pull any completed

fact finds to your Compliance Summary before these changes go live as the old fields that will no longer

show will be replaced with those above. If you do not pull completed fact finds to your Compliance Summary you will be asked to complete the new options upon validating your fact.

Individual Client > Main Details:

Fact Find > Personal Details:

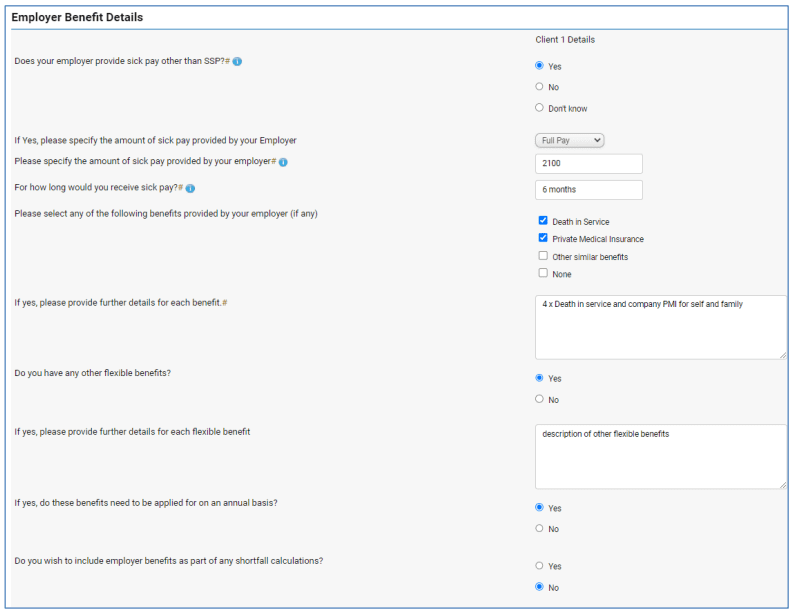

Fact Find > Personal Details > Employer Benefits Details

For consumer duty you are now asked to record the following information when reviewing your client

protection needs regarding their Employer Benefits:

- Does your employer provide sick pay other than SSP – Existing field.

- If yes, please specify the amount of sick pay provided by your employer – Existing field, however this was a free text box but has changed to provide you the following 3 options to select in a drop down:

- Full Pay

- Half Pay

- Reduced Pay

Note: existing fact find information held in the free text box will be lost following this release therefore ensure you have saved your Fact Find to the Compliance Summary.

| Original | Improvements |

| If Yes, please specify amounts | New question. This is a free text box so you can record more than one amount if need e.g. £1,200 at first then goes to £600. |

| If Yes, for how long would you receive sick pay? | Existing field. |

| Please Select any of the following benefits provided by your employer (if any) | New Question with the following options to check if applicable: – Death in Service – Private Medical Insurance – Other similar benefits – None |

Note: This question has replaced ‘Does your employer provided Death in Service, Private Medical Insurance or other similar benefits?’, which had a yes or no options to select. For historical data if ‘No’ has been previously selected this will have ‘None’ checked and for those with ‘Yes’ this will need completing again if you have not pulled your fact find over to the Compliance Summary prior to the release.

| Original | Improvements |

| If Yes, please provide further details for each benefit. | Existing field but amended question from ‘If Yes, please specify details’. |

| Do you have any other flexible benefits? | New question with yes or no options to select. |

| If yes, please provide further details for each flexible benefit. | New question with free text box for answer. |

| If yes, do these benefits need to be applied for on an annual basis? | New question with Yes or No option to select. |

| Do you wish to include employer benefits as part of any shortfall calculations? | New question with Yes or No option to select. |

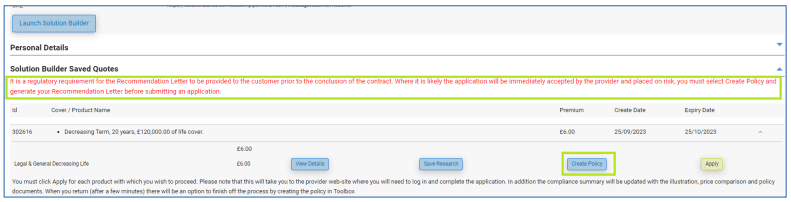

Get Quotation > Solution Builder page > Displaying Create Policy button alongside apply button

As part of the Consumer Duty changes, it is a regulatory requirement for the Recommendation Letter to

be provided to your customer prior to the conclusion of the contract where it is likely the application will be immediately accepted by the provider and placed on risk. For this reason, if you use the Protection

Wizard to generate your Recommendation Letter, you must ensure you select ‘Create Policy’ and

generate your Recommendation Letter before submitting an application.

Previously in Toolbox after pulling back a protection quote from Solution Builder you see the following

options:

- View Details

- Save Research

- Apply

When selecting Apply, it takes you to the Provider page to login and apply with the provider. It was only

when the Apply button is selected do you then see the Create Policy button alongside ‘Go to Provider’.

Therefore, to assist with the above requirements, we are now providing you with the Create Policy button

alongside the Apply button once a solution builder quote is pulled back into Toolbox. You will also see a

warning message at the same time as a reminder.