On 20 February 2024, the UK public was greeted with the welcome news that inflation had finally fallen to its lowest point for two and a half years – now sitting at a much more manageable 3.4%. This revelation has come as somewhat of a surprise amongst industry experts and other forecasters providing a somewhat more optimistic market outlook, however its undeniable that the end customer is still faced with significantly higher cost of living expenses.

While expectations were that the inflation rate would soon come down, most economists were under the impression that any reductions wouldn’t see the core inflation figure stray too far from 4.5%, which it originally sat at in February [1], however this hasn’t been the case and instead we’ve seen a more significant decrease.

In regard to the Bank of England base rate, which was the subject to plenty of discussion in light of the interest rate changes, many economists correctly predicted that rates would be held at a standstill.

Read below to find out how these decisions impact you as a mortgage broker in the UK.

Why has the UK inflation rate fallen?

While there are a number of factors which influence the rate of inflation, we can certainly say that the fall in food prices, which itself has slowed from 7% to 5% as recent as February, has had a significant impact. This comes nearly a full year after a peak was reached of 19.1% which occurred last March.

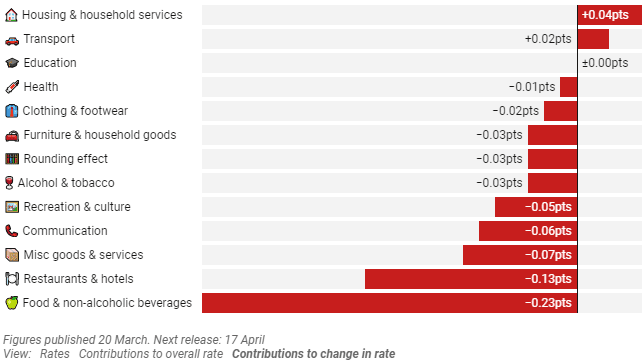

In addition to a slowdown in food prices, we have also seen other sectors contribute to the slump in inflation such as restaurants and hotels, second-hand cars, furniture and household goods, alcohol and tobacco and much more.

Services inflation, which is often used as a key metric by the Bank of England in determining the severity of inflation, has also eased in recent times which suggests an optimistic outlook for the future where general spending can be not only revived but encouraged.

The current 3.4% inflation rate represents the lowest point at which the rate has hit since September 2021, when the figure stood at just 3.1%.

Below you can see contributions to the 0.6 point decrease in the 12-month CPU inflation rate between January and February 2024.

Source: The Spectator, Inflations drops to its lowest level in two years, 20 March 2024 [2]

How has the BOE base rate been impacted?

Whilst news of a falling inflation rate suggested a reassessment in the base rates current standing, this has not been the case as of right now.

As of 21 March 2024, the Bank of England announced that its Monetary Policy Committee voted 8 to 1 in favour of holding interest rates at their current position, which at the moment stands at 5.25%.

In many respects, the door for cutting interest rates is certainly open in the near future. However, at this current moment in time, the ‘encouraging signs’ highlighted by economists have not been deemed as sufficient justification.

‘The UK’s cost of living crisis is ending and people have cheered up’ notes on MP representing the Conservative Party. [3] “whilst today’s decision wasn’t the much-needed cut that many of us were hoping for, it’s a sign that things are moving in the right direction. Economists believe that the economy has turned a corner after the last few years, with this week’s inflation drop.”

She continued “we know that millions of people need debt advice, and many are living on the edge. Customers need support navigating what these changes mean and they are likely to remain cautious around affordability. Brokers are equipped to offer expertise and context to help customers feel in control and make informed decisions.”

Regardless of what happens in the industry, PRIMIS Mortgage Network will ensure your brokers firm is supported and safeguarded against the unknown. Begin your journey as a PRIMIS adviser by clicking below, to get prepared for a promising 2024.

Begin Your Journey with PRIMIS

- [1] https://www.spectator.co.uk/article/inflation-drops-to-its-lowest-level-in-two-years/

- [2] https://www.spectator.co.uk/article/inflation-drops-to-its-lowest-level-in-two-years/#:~:text=Inflation%20has%20slowed%20once%20again,2%20per%20cent%20this%20spring.

- [3] https://www.independent.co.uk/news/uk/home-news/interest-rates-uk-inflation-bank-of-england-latest-b2516153.html